Download the full second quarter 2019 letter to learn more about Live Oak Private Wealth’s portfolio activity, performance characteristics and comments from the team.

“At heart, uncertainty and investing are synonyms.”

-The Intelligent Investor, Benjamin Graham(1949)

Introduction

Recently, our teammate Bill Coleman celebrated his 60th birthday. He and his wife are on a much-deserved vacation and celebration trip to Italy and Croatia. So, this quarter’s letter is a team effort.

Uncertainty reared its head again during the second quarter, especially in May. Most investors hate uncertainty, but as the quote above puts it, investing is an exercise in making decisions under conditions of uncertainty.

After a solid first quarter, stocks continued their advances in April. Perceptions related to the U.S. and China trade war shifted in early May as President Trump issued a deadline to increase the 10% tariffs to 25% on imports. For good measure, he also threatened Mexico with tariffs because of unresolved border and immigration issues. Consequently, May returns were the worst since 2010. The S&P 500, the Nasdaq, Russell 2000 delivered minus 7.93%, 6.64% and 6.69% returns respectively. Meanwhile, bond yields collapsed. Ten-year Treasury bonds now yield only 2.13%, down from 3.25% in the past six months.

We all seem to have short memories these days, so let’s go back nine months to October 2018. Yields were climbing, and the Fed was looking to raise rates due to positive economic data. Consequently, stocks tanked almost 20% in November and December due to worries that HIGHER bond yields would hurt stocks. However, the trade war started affecting the economies abroard and at home. Mario Draghi, President of the European Central Bank, was the first to announce monetary accommodations and the Fed soon followed suit discussing lower rates. Remember, that the price paid for a stock today represents the discounted present value of the future stream of earnings of the stock. A key component in the discount of the future stream of earnings is the interest rate. The lower the interest rate used in the discounting, the higher the present value of the stock. With the announcement of lower rates, the market took off, and yields decreased.

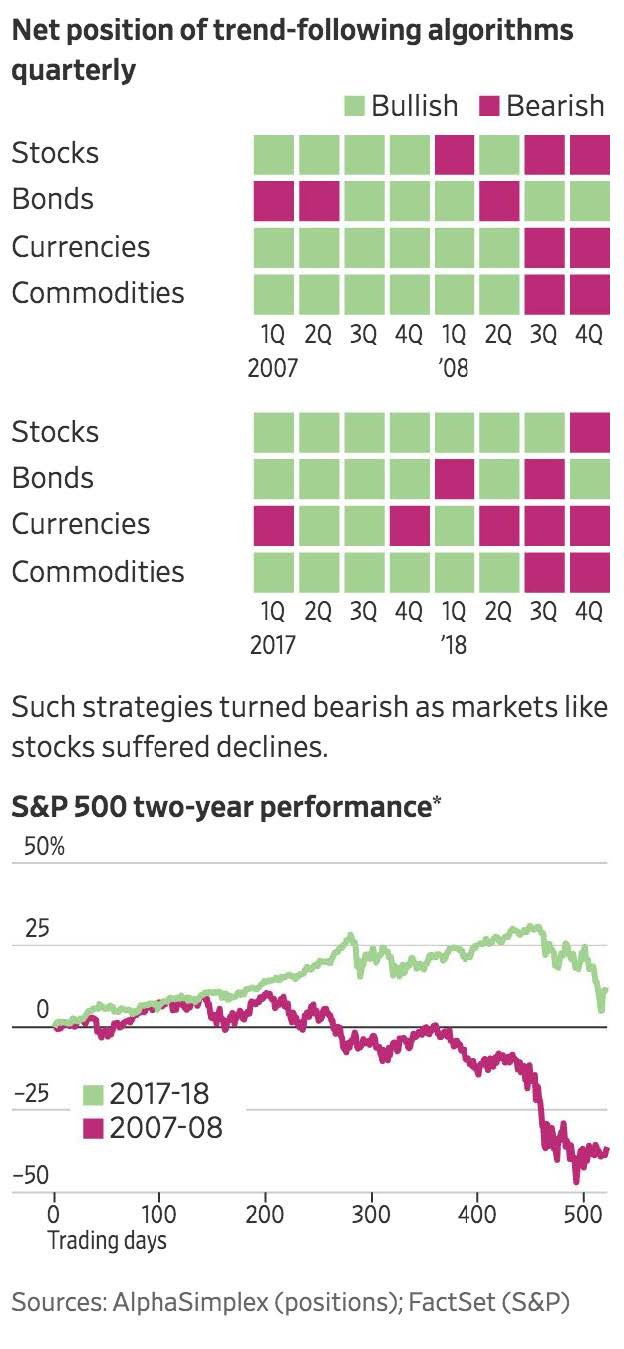

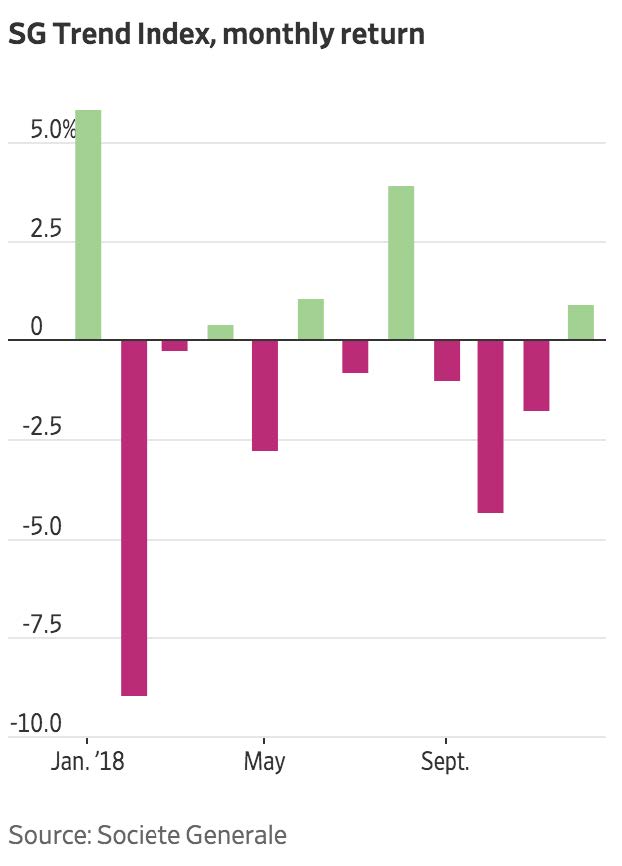

This market volatility was exacerbated by the computer trading that we have written about in previous letters. Programs are created to trade on headline news and market trends versus company fundamentals. For example, when news hit about new tariffs, markets traded down rapidly due to the program algorithms. Although such down days and volatility are scary, we use such events as opportunities to enhance positions or buy new positions. With our experience and battle-tested process, we know when companies are trading at attractive valuations. So, while we do not like that 20 – 30% of the market trading is driven by these computers, we do use their illogical trading to buy good companies at reasonable prices.

The big question is, where do we go from here? The bond and stock markets are priced in the 0.25% rate cut in July. Stocks are at all-time highs. In the early stages of earnings season, corporate profits seemed to be flat to modestly higher. There is no doubt that the record-long expansion is showing its age, but falling interest rates are propping the economy and companies. It seems like we have heard this song before—don’t fight the Fed. We believe that even if we receive good trade and economic news, the market would extend its gains, but not replicate the first two quarters.

So, we are back with market uncertainty for the last half of the year. If you have ever read a book about Naval SEALs, there seem to be two underlying common themes:

- Have a plan.

- When things change, you can only control what is in your reach–your wingspan.

We believe these two principles apply to Wealth Management too. Live Oak Private Wealth believes in every client having a financial plan that clearly outlines your goals and objectives. Through appropriate allocation, it shows a path to achieving your life dreams and gives peace of mind. But things change. The market certainly has volatility-trade wars, the 2020 election, etc. We can’t control that uncertainty. However, Live Oak Private Wealth can control its research (our wingspan) and the companies we invest in. We’re focused on companies with competitive moats, solid management, a good balance sheet and positive cash flow. So, when markets change, we know what we own and feel good about the companies in our portfolios.

Thank you for trusting Live Oak Private Wealth with your family’s planning and investing.

Live Oak Private Wealth on the Road:

The highlight of the second quarter (besides Bill’s 60th) was his annual pilgrimage to the Berkshire Hathaway annual meeting. He was fortunate to be included in the 2019 Value Investor Conference hosted by the University of Nebraska at Omaha Business School, which preceded the Berkshire meeting. You may be wondering why we share this with you. It directly relates to our collaborative research network. For example, in a break-out meeting, Bill posed a question about Google (which we own in our portfolio) to one of the noted speakers at the confer ence. Bill met the speaker’s analyst on break and continued the discussion. Since the meeting, they have had several conversations and e-mails, and they will be attending a fall conference together in New York. The next night, Bill met a noted portfolio manager from New York. That meeting led to an invitation to a conference in Richmond, Virginia that Connor attended. While there, Connor bumped into an acquaintance working for a fund in Dallas. He shared the fund’s insight on Facebook and their firm’s investment philosophy and process. We are steadily spreading our research network.

This lengthy anecdote is a perfect example of why we are different. Coupling our goals-based planning and research-focused investing helps us better understand risks and opportunities in the public markets, helping us construct better portfolios for you to achieve your goals and objectives.

Portfolio(s) Discussion and Commentary

Our investment team manages four equity portfolios in addition to our fixed income solutions. Each of these four equity portfolios is unique with different approaches. Each of the four portfolios is broken out below with separate commentary for each.

- Focused Opportunity

- Select

- Equity Income

- International

Our economy in the U.S. is still in a long expansion. It may be slowing slightly now due to trade war issues, and the geopolitical risks we eluded to in last quarter’s letter (rise of populism and threats to capitalism). But to u s, our economy shows no sign of impending recession. The Fed remains more than accommodative as inflation (by their measure) is low. Therefore, interest rates are ridiculously low. On a PE basis, bonds trade at 40 times earnings vs. stocks 17 times. Dividend yields on many stocks, which grew 10% in the last year, exceed yields on 10-year bonds. Corporate profits are healthy. Unemployment is at a 50-year low, and household net worth is at an all-time high. Things are good. Stock prices reflect this, yet they are not unreasonably high as in 2000. We feel positive about our portfolios, yet we still worry every day. Welcome to the world of the Live Oak Private Wealth investment team.

“Our money” is not an anonymous pool of capital. It’s your money, our parents’, our in-laws, partners’, mentors and friends’ money. It’s a privilege to help you manage these vital assets. Our team will continue to invest your capital alongside ours with a long-time horizon. We will also continue to treat it like it is our money—because i t is. Thank you for the opportunity to grow your family’s capital alongside ours.

We remain humbled and blessed by your willingness to compensate us for doing something that we love to do and is so meaningful and rewarding to us all. The Live Oak Private Wealth team looks forward to our continued shared success in this partnership.

Sincerely,

The Live Oak Private Wealth Team

Focused Opportunity Portfolio

Focused Opportunity Commentary and Thoughts

Our Focused Opportunity Portfolio is our signature investment portfolio, which carries our highest conviction opportunities. This portfolio has unlimited flexibility and can appear uncomfortably quirky at times. Bargain investments are usually found when a company has experienced a controversial event, general pessimism or poor performance. This portfolio invests across the capitalization spectrum and is conviction weighted to our most attractive companies.

In the second quarter, Focused Opportunity returned 4.84% (gross) and is up 16.28% to date (total).

Ten Largest Investments

June 30, 2019

| Year Acquired | Year Acquired | ||

|---|---|---|---|

| Berkshire Hathaway | 1998 | Google C | 2008 |

| Microsoft | 2006 | Carmax | 2018 |

| United Healthcare | 2012 | Charter Communications | 2007 |

| Apple | 2011 | HCA Healthcare | 2014 |

| Bank of America | 2013 | Visa | 2013 |

Portfolio Activity: During the 2nd quarter, we increased our positions in Google and United Healthcare.

Performance Attribution

| Contributors | Detractors | ||

|---|---|---|---|

| Carmax | +41% | Bank of New York | -16% |

| Disney | +22% | Schwab | -14% |

| Microsoft | +19% | Schlumberger | -12% |

| Mastercard | +16% | Fed Ex | -10% |

| Visa | +16% | CVS | -6% |

Focused Opportunity Featured Company:

Disney (Walt) Co

We are all familiar with Disney. But many fail to recognize the unique, unrepeatable assets Disney has. These assets are a competitive advantage that provides healthy margins and pricing power. Since recently acquiring the assets of 21st Century Fox, Disney’s position is bolstered by its leading position in media content and distribution. Disney owns 60% of HULU and is now rolling out a new over the top (OTT) subscription-based streaming service called Disney+. This platform could further leverage all of Disney’s properties and allow for deep cohesiveness to develop, share and promote (sell) more Disney content. Content is king, and Disney is incredibly well-positioned. The stock at its current price is a little expensive but should be a solid core investment for years to come.

Select Portfolio

Select Portfolio Commentary and Thoughts

Our Select Portfolio might be best understood using a sports analogy. Select consists of our bench players or our on-deck circle of companies. These are companies we admire and ones who compliment positions in Focused Opportunity. Select would be considered an all-cap core portfolio that is style agnostic. It invests across the capitalization spectrum yet leans towards growth. Select is also conviction weighted to companies we view have the best price to value relationship.

In the second quarter, the Select Portfolio returned 2.65% (gross) and is up 18.81% YTD (gross).

Ten Largest Investments

June 30, 2019

| Year Acquired | Year Acquired | ||

|---|---|---|---|

| Google A | 2009 | Markel | 1998 |

| Citigroup | 1998 | Anthem | 2002 |

| Fox Corp A | 2019 | Delta Airlines | 2017 |

| Lowes Companies | 2018 | 2019 | |

| Comcast | 2004 | Mohawk | 2018 |

Trading activity for the 2nd quarter: During the quarter, we sold Qualcomm and DowDupont. We increased our positions in Fox, Anthem and Lowes.

Performance Attribution

| Contributors | Detractors | ||

|---|---|---|---|

| American International Corp | +23% | Boeing | -17% |

| +19% | Apache | -15% | |

| Ecolab | +16% | Anthem | -8% |

| Delta Airlines | +16% | Liberty XM Sirius | -8% |

| Medtronic PLC | +11% | Google A | -5% |

Select Portfolio Featured Company:

Fox Corporation (FOXA)

The Fox Corporation is an American television broadcasting company headquartered in New York. It has reformed this year from the acquisition of 21st Century Fox by Disney. Fox Corporation was a spinoff from 21st Century Fox as a stand-alone company in March of this year. Fox offers “must-have networks” that are mainly immune to disruption from cord-cutters and over the top providers. The must-have networks are Fox News, Fox Sports, to name a few. Netflix said this about Fox in their letter to shareholders last year: “New Fox appears to have a great strategy, which is to focus on large simultaneous viewing of sports and news. These content areas are not disrupted by on-demand viewing in the way TV series and movies are, so they are more resilient to the rise of the internet.” Fox owns part of Roku and is underleveraged and converts almost all income to free cash flow. Fox possesses valuable tax deferrals as well.

Equity Income Portfolio

Equity Income Portfolio Commentary and Thoughts

Our Equity Income Portfolio, like our other three, is a concentrated portfolio. Equity Income consists of high-quality companies with sustainable competitive advantages. They all have average to above-average dividend yields, along with the potential for dividend growth. The portfolio’s objective is to offer the opportunity for attractive total returns with the possibility of slightly higher income.

Equity Income, like Select, Focused Opportunity and International, is a go-anywhere portfolio that is style and capitalization agnostic.

In the second quarter, the Equity Income Portfolio returned 2.48% (gross) and is up 11.97% YTD (gross).

Top Largest Investments

June 30, 2019

| Year Acquired | Year Acquired | ||

|---|---|---|---|

| JP Morgan | 2007 | Home Depot | 2004 |

| Walmart | 1998 | Intel | 1998 |

| Exxon | 1998 | Bristol Myers | 2018 |

| Chevron | 2017 | Target | 2018 |

| Cisco Systems | 1998 | Lockheed Martin | 2018 |

Trading activity for the second quarter: There was no trading activity.

Performance Attribution

| Contributors | Detractors | ||

|---|---|---|---|

| Air Products | +26% | Walgreens | -18% |

| Target | +19% | 3M | -16% |

| Lockheed Martin | +17% | Bristol Myers | -15% |

| Pepsi | +13% | Eli Lilly | -14% |

| Walmart | +13% | Intel | -10% |

Equity Income Portfolio Featured Company:

Air Products & Chemicals, Inc. (APD)

Many people don’t know about Air Products and their value as a business. They supply industrial gases to thousands of customers, which helps them become more efficient and sustainable. The company makes enormous quantities of hydrogen for energy companies to use to make gasoline, not to mention helium for our birthday balloons. Many also don’t know the everyday daily use of their gases. They provide high-priority gas to chill and freeze everything from shrimp and chicken to Sara Lee pound cakes. We all understand the concept of welding metal for automobiles and thousands of other metal products. It takes Air Products’ gas to make the welding torches work. The industrial gas business, which Air Products is the leader in, is a boring behind-the-scenes American business that is very profitable and sustainable. Our manufacturing economy could not function without them. We remain very comfortable as a long-term investor in Air Products.

International Portfolio

International Portfolio Commentary and Thoughts

International Portfolio: Our International Portfolio is also highly concentrated in what we feel are superior, growing businesses. The portfolio’s objective is to expose us as long-term investors to other opportunities worldwide. The mandate allows for unlimited geographical reach and can own any size capitalization business. The majority of the world’s growth is outside the U.S., and therefore, we hope to capitalize on that.

In the second quarter, the International Portfolio returned 1.91% (gross) and is up 19.81% YTD (gross).

Ten Largest Investments

June 30, 2019

| Year Acquired | Year Acquired | ||

|---|---|---|---|

| Nestle | 2002 | JD.Com | 2018 |

| Alibaba | 2018 | Safran | 2018 |

| Fiat Chrysler | 2018 | Ten Cent | 2018 |

| New Oriental Education | 2018 | Development Bank of Singapore | 2018 |

| Ferguson | 2019 | Naspers | 2018 |

Trading activity for the second quarter: We sold Daimler and Fairfax Financial and added Hollysys Automation Technologies Ltd. and Schneider Electric.

Performance Attribution

| Contributors | Detractors | ||

|---|---|---|---|

| Linde | +19% | Baidu | -28% |

| Allergan | +19% | Alibaba | -8% |

| New Oriental Education | +17% | Fiat Chrysler | -6% |

| Schnieder | +15% | DNB Asa | -3% |

| Nestle | +14% | Lanxess | -1% |

International Portfolio Featured Company:

Hollysys Automation Technologies Ltd. (HOLI)

Founded in 1993, Hollysys is a provider of automation and control technologies and products. In fact, they’re the leading

provider in China. Hollysys has a nationwide presence in 60 cities. Their proprietary technologies and products are tailored to

industrial, rail, subway and nuclear industries. This product line includes:

- Sensors that enable automated production lines to function

- Sensors that control robots, like human eyes

- Technology that relates to the train and subway systems in Asia

- A bullet train one-speed protection mechanism that enables optimal rail logistics in the Asian region

We like the long-term prospects of Hollysys as the leader in artificial intelligence and technology automation.

Appendix 1

Live Oak Private Wealth Investment Philosophy

Three Pillars

We consider potential losses before gains. We think about multiple scenarios that could affect us. We ask how much might we lose before we ask how much we might make.

We focus on absolute returns, not relative returns. Our goal is to lose less than the market. We don’t manage to a benchmark.

We do not focus on the macroeconomic environment. We focus on great businesses we can invest in at a fair price.

Our Beliefs

We believe your lifetime investment results will be mostly governed by two variables: behavior and asset allocation.

We consider the three quotes below by two very famous investors daily in our thoughts, research and work.

“To buy when others are despondently selling and to sell when others are avidly buying requires the greatest fortitude

and pays the greatest reward.” – John Templeton

“Be fearful when others are greedy and greedy when others are fearful.”

“Price is what you pay; value is what you get.” -Warren Buffett

Guiding Principals

- A share of stock represents a share in the ownership of a business.

- A stock exchange is nothing more than an auction place that provides a convenient means for exchanging your

ownership in business for cash and vice-versa. - Our investment approach would be akin to applying a private equity mindset to investing in public markets.

- We limit our search for qualifying investments to good businesses. They have identifiable, sustainable competitive

advantages. - Risks to us are permanently losing capital over a five-year time horizon. Market volatility is not a risk to us.

- Our primary return goal is to compound money at real rates of return (4-5%) above inflation over our five-year time

horizon. - Compounding capital at 7% doubles your assets in 10 years.

Disclosures

1) Past performance is no guarantee of future results and future performance may be higher or lower than the performance shown.

2) This performance composite represents results from all actively managed, fully invested accounts at the firm. The composite results include all accounts managed for capital appreciation and income.

3) There can be no assurance that our portfolio management or any account managed by our investment managers will achieve a targeted rate of return or volatility or any other specified parameters. There is no guarantee against loss resulting from an investment.

4) Performance is presented net of fees. Calculated using Orion standards. Periods greater than one year are annualized. This information has been obtained from sources that were deemed reliable, but cannot be guaranteed nor verified.

5) The method for calculating the composite returns includes a monthly weighted (weighting of monthly beginning values, adjusting for time-weighted average returns to derive quarterly and annual returns.

6) Investment objectives, returns, and volatility are used for measurements and/or comparison purposes only and are only a guideline for prospective investors to evaluate our investment strategy and the accompanying risk/reward ratios.

7) Comparison to any index is for illustrative purposes only. Certain information, including index and benchmark information, has been provided by third-party sources, and although believed to be reliable, has not been independently verified and its accuracy cannot be guaranteed.

8) The information contained here is not complete, may change, and is subject to, and is qualified in its entirety by, the more complete disclosures, risk factors, and other important information contained in Part 2A or 2B of Form ADV. This presentation is for informational purposes only and does not constitute an offer to sell or as a solicitation.

9) Live Oak Private Wealth is a subsidiary of Live Oak Bank. Investment advisory services are offered through LOPW, LLC, an Independent Registered Investment Advisor.

10) Opinion and thoughts expressed are those of Bill Coleman and not Live Oak Bank.