Introduction

“We have a lot of money. We need to get that money in Americans’ hands.”

-Treasury Secretary Steven Mnuchin 2020

“Forecasts create the mirage that the future is knowable.”

-Peter Bernstein

It is hard to believe this year is over. It has definitely been one for the history books in a lot of ways. Much will be recollected in many ways in year-end letters from the investment industry, so we won’t try and be too novel in our year-end thoughts. We can say it is exciting and feels good to be writing this as vaccines are being distributed. America’s future has always been bright, but 2021 is shaping up to hopefully deliver much more optimism.

2020 was a very good year for Live Oak Private Wealth, notwithstanding the challenges from the virus and the uncertainties around the election. We had what we consider solid investment results in line with long-term historical average returns. We were able to upgrade the quality of our portfolios during the depths of panic selloff in March. We refined and enhanced additional policies, procedures, and disciplines operationally, which has led to an even higher level of client service and commitment. We achieved two significant milestones: 1) we successfully merged Jolley Asset Management into Live Oak Private Wealth and integrated personnel and systems and 2) Live Oak Private Wealth became verified by the CFA Institute as compliant with the Global Investment Performance Standards (GIPS®).

Sophisticated investor demand drives product innovation, and the CFA Institute and the GIPS® standard ensures best practices for performance reporting and presentation. Adopted mostly by the top asset management firms, Live Oak Private Wealth is proud to be one of the few investment firms to be verified as GIPS® compliant. We should note that Frank and his firm have been compliant and verified for almost 20 years. The verification process was lengthy, arduous, and difficult. Client Service Associate, Missy Musser, took on this challenge and our entire firm is grateful for her efforts.

We hope you are finding our newly formatted quarterly letters beneficial. We are trying to mesh and combine 25 years of separate writing styles and methods into one cohesive, thoughtful communication. Why do we write these lengthy letters versus publish a “newsletter”? Writing is focused thinking put to words. We realize the format of this joint effort is different from what you have received in the past, but we feel like it is important for you to know what we invest your family’s money in and why. Again, we welcome your comments.

The market this quarter has been hot! Thomas Peterffy, the billionaire founder of Interactive Brokers, who first started trading on the now-defunct American Stock Exchange in the 1970s, says the current environment is unlike anything he has ever seen before. The euphoria surrounding stocks is clear for all to see, as Goldman Sachs recently pointed out on December 2 that the median S&P 500 stocks’ short interest is at its lowest level dating back to at least 2004. Similarly, Investors Intelligence Sentiment Data shows that market participants are the most bullish they have been since January of 2018. To put this level of bullish sentiment into perspective, it is the third-highest bullish reading in more than 30 years. The “everything rally” is the siren call that is drawing all in. Sentiment Trader noted recently in December the number of small traders (Robinhood and others) buying call option contracts as a percentage of total option volume is at record levels, outpacing levels seen during the 2000 tech bubble.

Wall Street loves a bull market. From our perspective, the IPO mania is back and if you can’t pull off an IPO, then just merge with a special-purpose acquisition company (SPAC)! It feels very frothy to us. Many newly minted IPOs are trading at 200 times… revenue! Not earnings. According to the Wall Street Journal, through September 30, U.S. venture capital funds have invested $88 billion, well above the $66 billion for all of 2000. As stated in last quarter’s letter, we are having certain feelings of déjà vu when considering 2020’s market with the 1999-2000 period.

Sanity will return. When you are in a bubble, it is hard to see. Given the valuations today with some of the tech highfliers, we believe an awful lot has to go right for a long, long time to justify today’s prices. Investing is not as easy as it appears to many these days. When investing seems this easy, it may be time to keep a sense of humility and try to maintain perspective that the “good” times may not last.

Market Review

It was approximately nine months ago when the S&P 500 Index lost a third of its value in about a month’s time. The equity markets were in bear market territory and coronavirus cases were surging. Restaurants, airlines, retail stores and theaters essentially went dark and unemployment was surging. We think it is safe to say that not one of our clients expected the markets to bottom on March 23 and for the S&P 500 to rally by some 68% into year-end. The S&P 500 ended the year at record levels and the NASDAQ Composite had its best year since 2000 with a 43.6% gain. The Dow Jones Industrial Average vaulted above 30,000 for the first time on November 24, up 60% from its March nadir. The markets’ dizzying rise in recent months has been powered by easy money provided by central banks, massive government stimulus, and the hopes surrounding the vaccines. All of the above happened as the U.S. economy is estimated to have contracted by 3.5% and S&P 500 earnings are estimated to have fallen by approximately 15%.

The past year was dominated by growth and mega-cap tech issues. The Russell 1000 Growth Index outperformed the Russell 1000 Value Index by 35.7%, the largest spread since 1979. Value did start to outperform growth in the fourth quarter as investors began to bet on an economic and profit recovery in 2021. Once again, the S&P 500 Index was driven by large-cap technology issues and returned 18.4%, while the S&P Equal-Weight Index returned 11. 5%. As was the case with the value indexes, the equal-weight index began to outperform the S&P 500 Index (market-cap weighted) by a considerable margin in the fourth quarter. In 2020, the market leaders were information technology (+42%), discretionary (+32%), and communication services (+22%). It should be pointed out that the discretionary sector is dominated by Amazon, while the communication services sector’s heaviest weightings include Alphabet, Facebook, Netflix and Twitter. When those factors are considered, you can easily conclude that technology was the dominant market theme in 2020. In the past year, market laggards were energy (-37%), real estate (-5%), financials (-4%), and utilities (-3%).

| Index | 2020 4th Qtr | 2020 YTD 12 Months |

|---|---|---|

| DJIA | 10.7% | 9.7% |

| S&P 500 | 12.2% | 18.4% |

| S&P 500 (equal weight) | 18.6% | 11.5% |

| S&P Mid Cap | 24.4% | 13.7% |

| Russell 1000/Growth | 11.4% | 38.5% |

| Russell 1000/Value | 16.3% | 2.8% |

| Russell 2000 | 31.4% | 20% |

| NASDAQ Comp. | 15.4% | 43.6% |

Growth Strategy

Commentary and Thoughts

Our objective and mandate for the Growth at a Reasonable Price strategy is to invest in good, growing companies and have the willpower and patience to hold our position for a long time to reap the value of compound growth. The majority of our best performance over the years has been a result of buying what we believe to be good companies and holding on. S. Allen Nathanson wrote a column in the late 1960s (before blogs and podcasts) and was known for his saying “Trade for Show, Hold for Dough.” Often, big returns are back-end loaded and you have to endure many peaks and valleys in a journey with a great growth business. We have endured long stretches of time where a stock went nowhere while others smoked by us in the fast lane. Media headlines screamed at us – challenging us to do something. Many times, it was best to sit on our hands.

We recently read an enlightening research piece from @mastersinvest regarding our appreciation for compounding with great growth stocks. Two things matter for the “magic” of exponential compounding to occur, high rates of return and longevity. Over the long run, just a few percentage points of differential in annual returns translates into staggering differences in financial outcomes.

But it is hard to patiently wait as capitalism is brutal. If you have a great, profitable and growing business, you will pop up on somebody’s radar, attracting attention and copycats, and your edge gets competed away. The key is finding a few rare companies that have defied the competition. They possess a rare, unique edge that stiff-arms the competition. Many times, we made the mistake and failed to appreciate the longevity of some growth stocks due to a myopic valuation discipline (since many of us cut our teeth as value managers, avoiding high P/E stocks). At times, we failed to have the appreciation of the durability and competitive advantages of say Amazon, Starbucks or Southwest Airlines who had very high growth rates in the early years (with very high P/Es) that we thought would fade due to the competition’s mean reverting forces.

Terry Smith, an investor we admire in London, made a great point in his new book called “Investing for Growth.” Smith states,

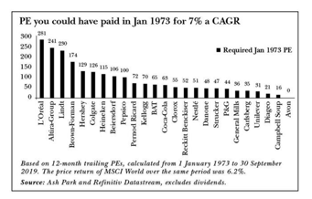

”The level of valuation which may represent good value at which to buy shares in a high- quality company may surprise you. The following chart shows the ‘justified’ P/E’s of a group of stocks of the sort we invest in.”

Considering the above, an investor who wanted to outperform the MSCI World Index from 1973 to 2019 would have required about a 6.5% return. Looking at the above table, it is astounding to think you could have paid 129 times earnings for Hershey or 281 times for L’Oreal and earned 7% compounded for 46 years.

We don’t seek out expensive stocks, but hopefully by knowing our companies well and holding a variant perspective (along with some willpower) regarding the durability and sustainability of growth and resultant future business value, we can remain invested in our compounders over many market cycles.

Fourth-Quarter Portfolio Activity

Trading was very light during the quarter, as the market literally traded straight up, with the only notable change was selling Schlumberger. Obviously, we, like many, treaded lightly into the election, expecting there to be potential volatility to act upon. Tax policy, regulations of high tech, global trade, and healthcare reform were all points of discourse in November. We held back, being cautious, expecting to deploy capital at lower prices during election volatility. Somewhat surprisingly, we didn’t get the volatility many expected (except for Connor, who said all summer the market was going to be wrong.)

The positive vaccine news and government stimulus ended up trumping the political election noise. The Biden proposal to increase the corporate tax rate to 28% and to potentially increase the capital gains tax rates hangs in the balance. We will be ready to add to a few of our stalwart companies should we experience significant downside volatility.

The quarter was busy with many virtual investor days. We participated with management in Lowes, United Health and Disney and came away quite comfortable investing alongside these great businesses. Reported third-quarter earnings for the majority of our companies were quite solid, and some were stellar like Fed Ex, Dollar Tree and Charter.

Contributors and Detractors For Growth Strategy

Our thoughts on portfolio positions that had the most positive impact on the strategy for the period ending 12/31/2020

Walt Disney Co. (DIS) (+47%)

Disney continues to effectively fight the coronavirus. Its diversified media platform resiliency coupled with the overwhelmingly positive response to its streaming video business, Disney +, remains one of the world’s most valuable companies.

Schlumberger (SLB) (+45%)

Schlumberger’s market-leading position in the energy engineering and consulting business provides some downside protection. Unfortunately, the company’s stock is too highly correlated with oil prices, which continue to be depressed by the pandemic and ESG mandates. We elected to finally sell our shares this quarter.

Charles Schwab (SCHW) (+41%)

Schwab owns a very valuable platform in the financial services industry and with the addition of TD Ameritrade, gains a scale advantage to add even more customers via low-cost service and leading technology.

HCA Healthcare (HCA) (+32%)

HCA Healthcare operates the largest network of hospitals in the U.S. focusing on attractive geographic locations, which provides what we consider a good positive demographic factor. With the end of the pandemic coming soon, along with effective vaccines, HCA has seen a pickup in elective procedures that had been delayed.

Wells Fargo (WFC) (+28%)

Wells Fargo continues to deal with unique headwinds: a regulatory-driven asset cap and bloated cost structure. New management is resolving these issues and improvements can materially improve the bank’s earnings. At its core, we believe Wells remains a strong commercial banking franchise with a large deposit base.

Our thoughts on portfolio positions that had negative or the least positive impact on the strategy for the period ending 12/31/2020

Air Products and Chemicals Inc. (APD) (-7%)

Air Products is one of the leading industrial gas suppliers globally, with operations in 50 countries and has a unique portfolio serving customers in a number of industries, including chemicals, energy, healthcare, metals, and electronics. Demand for industrial gas strongly correlates to industrial production, which should be favorable in 2021.

Lockheed Martin (LMT) (-7%)

Lockheed Martin is one of the highest quality defense prime contractors. Being the main contractor on the F-35 program with its 50-year contract lifespan coupled with its missile business, gives us comfort in the company’s long-term growth profile.

Lowes (LOW) (-4%)

Lowe’s posted its third consecutive quarter of double-digit same-store sales increases. The company continues to take market share benefitting from a 19% increase in building materials and garden equipment.

Moody’s Corporation (MCO) (-1%)

From our perspective, Moody’s Corporation and its credit rating agency remains well-positioned to take advantage of long-term trends such as banking disintermediation and continued development in global bond markets. The analytics side of the business enjoys a valuable subscription revenue model with high retention rates.

Verizon (VZ) (-1%)

Verizon’s strong position in the wireless business should bode well for continued stable revenue and cash flow. The wireless business is capital intensive and VZ is spending more than ever on additional spectrum for 5G. We will watch closely for shareholder return from 5G given these large capital outlays.

Classic Value Strategy

Commentary and Thoughts

Last quarter, we stated that it was our expectation that the extreme valuation discrepancy between the most expensive and least expensive stocks would likely narrow as investors began to anticipate an improving economic environment. The pandemic had widened the disparity between the handful of winners and the rest of the market to what we thought to be unsustainable levels. Our belief that “value” strategies would begin to outperform “growth” began to unfold in the past quarter. For the quarter just ended, the Russell 1000 Value Index returned 16.3% versus 11.4% for the Russell 1000 Growth counterpart. The opportunity for value reminds us of the 1999-2000 period when the pendulum swung from growth to value. For the next ten years (following 12/31/99), the Russell 1000 Value Index outpaced the Russell Growth by approximately 6.5% a year, and the S&P 500 Index by 3.4% a year. In a recent letter (12/8/2020) by GMO, Ben Inker stated that “U. S. Value”—as GMO defines it—”now trades at the fourth percentile or relative valuation on the blend of metrics that we generally use to evaluate the group’s attractiveness.” If value stocks are cheap relative to the market, then the implication is that growth stocks are expensive. The chart below shows that on a price/sales basis, growth stocks are more expensive than they were in 2000.

Sources: GMO, Worldscope, Compustat, MSCI

The Hare and the Tortoise

A Hare was making fun of the Tortoise one day for being so slow. “Do you ever get anywhere?” he asked with a mocking laugh. “Yes,” replied the Tortoise, “and I get there sooner than you think. I’ll run you a race and prove it.” The Hare was much amused at the idea of running a race with the Tortoise, but for the fun of the thing he agreed. So the Fox, who had consented to act as judge, marked the distance and started the runners off. The Hare was soon far out of sight, and to make the Tortoise feel very deeply how ridiculous it was for him to try a race with a Hare, he lay down beside the course to take a nap until the Tortoise should catch up. The Tortoise meanwhile kept going slowly but steadily, and, after a time, passed the place where the Hare was sleeping. But the Hare slept on very peacefully; and when at last he did wake up, the Tortoise was near the goal. The Hare now ran his swiftest, but he could not overtake the Tortoise in time.

When examining investment styles, one could easily label the “value manager” as the Tortoise and the “growth manager” as the Hare. Currently, no one is giving the value manager (the Tortoise) much of a chance. The key to long-term compounding of money is the elimination of large drawdowns. We believe that investing with a “margin of safety” gives our clients the best chance to succeed over the long term. Value investing is not a simple philosophy to practice. Many who attempt or claim to be value-oriented fail to maintain the discipline or patience required to succeed. However, it is that very discipline and patience that enables the value investor to avoid getting caught up in speculative bubbles, even during periods of short-term underperformance. In investing, we believe that slow and steady wins the race.

Fourth-Quarter Portfolio Activity

The market essentially had a “melt-up” in the fourth quarter, as positive news about the COVID-19 vaccine trumped any political uncertainty. With the vaccine, investors and algorithmic traders began to factor in a reopening of the economy, which resulted in strong performance for many of the more cyclical areas of the market. Overall, our portfolio activity was light with most changes focused on year-end tax planning and account rebalancing.

We did add one position in the fourth quarter, International Flavors and Fragrances, IFF is a specialty chemical company and a market leader in the global flavors and fragrance industry. The company specializes in creating flavor and scent compounds, which it markets to consumer products companies for use in food, beverage, perfume, and consumer cleaning markets. IFF shares were added in mid-November and currently yields approximately 2.6%, making this a potentially attractive total return.

Contributors and Detractors For Classic Value Strategy

Our thoughts on portfolio positions that had the most positive impact on the strategy for the period ending 12/31/2020

Invesco Ltd. (IVZ) (+55%)

Invesco shares rallied as Trian Fund Management, led by Nelson Peltz, took a 9.9% position in the company. Trian has urged IVZ management to explore certain strategic combinations with one or more companies in the asset management industry. Invesco shares continue to appear attractive trading at 9 times projected earnings and yield 3.4%.

Disney (DIS) (+47%)

Despite problems at their theme parks and suspension of the annual dividend, Disney shares surged as the company has accelerated the pivot to streaming and the Disney + offering. DIS shares have also attracted activist investor Dan Loeb of Third Point Capital. We believe shares remain attractive long term as the company has the ability to successfully compete with Netflix in streaming and profitability should also see a boost as theme parks rebound in the second half of 2021.

Charles Schwab (SCHW) (+41%)

Schwab shares reacted positively to closing its acquisition of TD Ameritrade. The combined entity should realize approximately $2 billion in cost savings and be accretive to earnings in the range of 10% to 15% by year three. Going forward, SCHW should also benefit from higher net interest margins as interest rates move off of zero.

Sony (SNE) (+ 32%)

Sony shares have reached a multi-decade high as the company has rolled out its PlayStation 5 game console. We believe Sony is also well-positioned to grow its image sensor business, which is used in the smart phone market and autonomous vehicle market. Sony recently raised its annual profit forecast.

JP Morgan (JPM) (+31%)

JP Morgan shares had a strong quarter as investors anticipate a strong earnings recovery in 2021. After recent stress tests, the Fed is allowing JPM to resume buybacks and the company announced a $30 billion buyback in mid-December. We believe the shares remain attractive at approximately 13.6 times forward earnings and yield 2.7%.

Our thoughts on portfolio positions that had negative or the least positive impact on the strategy for the period ending 12/31/2020

Intel (INTC) (-5%)

Intel shares have been weak as the company’s third-quarter results missed expectations largely due to weakness in the Data Center group. Intel also recently reaffirmed the delay of its latest generation chips. The shares remain extremely cheap, trading at 11 times trailing earnings and yield over 2.5%. In recent weeks, activist investor Dan Loeb of Third Point Capital has taken a position in the company, calling on the company to explore strategic alternatives.

Dominion Energy (D) (-4%)

Dominion shares have essentially been tracking the electric utility group, which have lagged the market over the past year. The company recently completed the sale of its midstream natural gas operations to Berkshire Hathaway, reducing its debt load and repurchasing shares with the proceeds. The shares currently yield 3.5%.

Unilever (UL) (-3%)

Unilever shares have lagged the market in recent months, despite first-half earnings coming in better than analysts’ expectations. UL is a high-quality defensive stock trading at a discount to its competitor Proctor and Gamble. We believe Unilever is well-positioned to benefit growth in emerging economies. Unilever shares yield 3.2%.

Verizon (VZ) (-1%)

Verizon shares have trailed the market over the past quarter as earnings came in slightly below estimates due to COVID-19 challenges. We think the shares are an attractive total return vehicle with the shares trading at only 12 times earnings and yielding just under 4.3%.

International Flavors & Fragrances (IFF) (-1%)

International Flavors and Fragrances shares were purchased in the fourth quarter as the shares reacted negatively to a small third-quarter earnings miss. IFF shares have been weak over the past year as the company is in the process of acquiring Dupont’s Nutrition and Biosciences Division. Analysts expect a rebound in margins next year, which should lead to higher earnings. IFF shares yield 2.6%.

International Strategy

Commentary and Thoughts

Many analysts have commented lately that there may be more opportunities globally than in the U.S. We concur that valuations outside the United States are generally lower and therefore, potentially more attractive. As an example, as of September 30, 2020, the Shiller (CAPE) adjusted P/E ratio was 19.6 for Europe, 20.2 for Japan compared to 32.1 for the U.S. There has been outsized outperformance for the U.S. markets since 2008. When looking at longer periods historically, international markets cluster around very similar returns as the U.S. Returns have been higher in the U.S. recently due to the bifurcation of the S&P 500 Index and the effect of large-cap tech stock outperformance, but we appear to be on the verge of a shift back towards better international returns. Europe is quite tech light and heavier in sectors sensitive to economic performance. This has been driving our “barbell” approach to investing in technology stocks in Asia and value-oriented, cyclical, and industrial European stocks. Europe continues to fight the virus and is holding up quite well especially benefitting from the recent passage by the EU of an unprecedented stimulus package ($750B Euro European Recovery Fund). We obviously are watching closely the recent developments surrounding heightened regulations of Chinese internet companies.

We made no changes to the International strategy this quarter, other than adding slightly to Roche Holdings in a few accounts. We witnessed nice rebounds in Heineken and Euronet Worldwide as vaccine hopes buoyed their shares this quarter.

Contributors and Detractors For International Strategy

Our thoughts on portfolio positions that had the most positive impact on the strategy for the period ending 12/31/2020

Baidu (BIDU) (+71%)

Baidu is the largest internet search engine in China and generates the majority of its revenue from online marketing services. Baidu experienced what we consider a nice increase in ad spending as both Chinese user and advertiser activities within the Baidu ecosystem were more positive than expected.

Euronet Worldwide (EEFT) (+51%)

Euronet Worldwide is a global financial payments technology company with one of their leading businesses being ATM machines predominantly in eastern and southern Europe. Potential positive effects from the vaccines led to optimism of travel picking back up in Europe. Euronet also could be boosted by its successful modernization of digital payments systems for banks in India.

Safran (SAFRY) (+44%)

Safran is a France-based high technology company well known for its aircraft and rocket engines and propulsion systems. Safran’s stock was boosted by optimism of commercial travel resuming due to positive vaccine developments.

Airbus (EADSY) (+44%)

Airbus is a major aerospace and defense firm operating within a global duopoly with Boeing in the commercial aircraft market. Like Safran, Airbus stock was boosted by optimism of commercial air travel resuming due to positive vaccine developments.

DNB ASA (DNHBY) (+42%)

DNB ASA is a Norway-based financial institution providing mortgages, car, and consumer loans, savings and investments. DNB ASA was boosted this quarter by government bond yields increasing and the markets’ willingness to think that the worst is behind the banks related to the pandemic.

Our thoughts on portfolio positions that had negative or the least positive impact on the strategy for the period ending 12/31/2020

Alibaba Group (BABA) (-20%)

Alibaba is the world’s largest online and mobile commerce company. Alibaba is very large in financial services, logistics, and cloud computing as well. Alibaba’s stock is temporarily depressed due to the Chinese government’s antitrust regulatory guidelines as well as the suspension of the Ant Group IPO.

Sanofi (SNY) (-3%)

Sanofi has a lineup of branded drugs and vaccines that focus on areas such as diabetes, rare diseases, oncology and immunology. Sanofi is differentiated from its peers with its material emerging markets’ sales.

Unilever (UL) (-3%)

Unilever continues to invest in growing the brand power of its various products with more efficient marketing spending in an evolving retail landscape in which physical shelf space is becoming less important. The company has a favorable product mix and roughly 60% of sales come from outside North America and Europe.

Nestle (NSRGY) (-2%)

Nestle has transformed itself into a global nutrition, health, and wellness company. We believe Nestle’s global distribution network and entrenched supply chain relationships make it a formidable resilient growth company. Pricing power in its confectionary business has weakened slightly but should rebound as economies continue to open up.

Icon (ICLR) (-1%)

Icon is one of the larger contract research organizations (CRO) in the world and competes in one of the more lucrative CRO areas, long, complex trials with thousands of patients. We believe new business, as well as its backlog, remains strong as biopharma research continues to increase around vaccines and treatments.

The year 2020 will go down in history for a lot of reasons. Thinking back to this time last year, writing this same letter, we could not have envisioned or predicted the events of 2020. We will not start now forecasting and predicting what we think will happen in 2021.

We honestly have no idea what will happen in 2021 or beyond. Forecasting is difficult at best, particularly when it comes to financial markets – a domain in which the rules of the game are poorly understood, information is invariably incomplete, and expertise often confers surprisingly little advantage in predicting future market moves. We feel it is smarter to study history and we feel that our collective 75 years of investment experience has value. We have a deep appreciation for economic and investing history because it can help us calibrate our expectations for the future. Many times, all of us, investors or not, make decisions based on simplistic extrapolations of the past. If you can extrapolate anything from the past, it’s that the world is a surprising place and that we should use the surprises of this year as a guide and an admission that we have no idea what might happen next.

We obviously think deeply and deliberately about uncertainty and risk as it relates to your family’s money. We are in the decision-making business. We feel like we should strive for better decision outcomes based not on extrapolating history from the past, but on smart estimates of the future. Philip Tetlock, co-author of “Superforecasting: The Art and Science of Prediction” writes about reconciling two approaches to decision making: scenario planning and probabilistic forecasting. Each approach has a fundamentally different assumption about the future. Scenario planners have hundreds of imaginable ideas, but probabilistic forecasters look more at odds of possible outcomes and transform the uncertainty into quantifiable risk. Each of these methods has its strengths, in our opinion, but the optimal approach is to combine them.

At the end of the day, from our desks, we think deeply about the businesses we are invested in. We contemplate, discuss, and weigh probabilities against different scenarios that may unfold this upcoming year and beyond. Since we can’t predict what will happen with our stocks or the market, we continue to invest with a margin of safety so that forecasting is not necessary. Maintaining a margin of safety, or room for error, is the only way to navigate an uncertain world.

Investing your family’s wealth is not an endeavor we take lightly. Investing with a margin of safety drives everything we do – asset allocation, security selection and amount of cash reserves. Maintaining a healthy room for error will allow us to endure the range of potential outcomes that lie ahead.

Paramount to our philosophy and vision as your trusted advisors lies in the importance of a well-thought out goals-based wealth (financial) plan. By having this important plan or roadmap, we have already considered many future scenarios and have calculated probabilities incorporating historical returns, risk/reward tradeoffs related to your goals and objectives for your family. This plan helps us to define the proper amount of margin of safety needed. Think back to March of this year when we were all surprised by the pandemic panic selloff of 35%. That amount of volatility can be potentially very detrimental to investors without a plan and without room for error. Having confidence in what amount of a drawdown you can endure versus reacting emotionally and making a large mistake is the key to our planning relationship with you and your family.

We hope that you feel comfortable in knowing you have a plan and that your Live Oak Private Wealth team embodies the humility to recognize the difficulty in forecasting and therefore, has a plan for unknown future scenarios. Our plan would involve healthy communication and could lead to an asset allocation change or whatever adjustment may be needed. Our team will continue to invest your capital, as well as our own, with a margin of safety and room for error as we attempt to distill the uncertainties ahead into quantifiable risks to assess. The most important part of every plan is building in a margin of safety for the unexpected, which can happen more times than you may think. This is what we are here for, by your side, making sure we have room for error in what we can’t predict. We really love what we do for you and enjoy feeling secure in our curated investment portfolios we have thoughtfully constructed based on your goals and objectives.

We remain humbled and appreciative of your willingness to compensate us for doing something we love to do and is so important to us all. Our entire Live Oak Private Wealth team looks forward to our continued shared success in this partnership.

With warmest regards,

Co-Chief Investment Officer

Co-Chief Investment Officer

Disclosures

1) Past performance is no guarantee of future results and future performance may be higher or lower than the performance shown. The performance results for each equity sleeve are calculated for us by Orion Services and does not reflect investment management fees, custody and other costs or taxes. All of which would be incurred by an investor in any account managed by Live Oak Private Wealth.

2) The performance attribution represented is a simple point-to-point price percentage change for the five best and five worst portfolio positions for the fourth quarter ending December 31, 2020. Each equity sleeve does not and is not intended to indicate past or future performance for any account or investment strategy managed by Live Oak Private Wealth. Additionally, there is no guarantee that all portfolios will own any or all of the companies mentioned.

3) There can be no assurance that our portfolio management or any account managed by our investment managers will achieve a targeted rate of return or volatility or any other specified parameters. There is no guarantee against loss resulting from an investment.

4) Investment objectives, returns, and volatility are used for measurements and/or comparison purposes only and are only a guideline for prospective investors to evaluate our investment strategy and the accompanying risk/reward ratios.

5) Comparison to any index is for illustrative purposes only. Certain information, including index and benchmark information, has been provided by third-party sources, and although believed to be reliable, has not been independently verified and its accuracy cannot be guaranteed.

6) The information contained here is not complete, may change, and is subject to, and is qualified in its entirety by, the more complete disclosures, risk factors, and other important information contained in Part 2A or 2B of Form ADV. This presentation is for informational purposes only and does not constitute an offer to sell or as a solicitation.

7) Live Oak Private Wealth is a subsidiary of Live Oak Bank. Investment advisory services are offered through LOPW, LLC, an Independent Registered Investment Advisor. Registration does not imply a certain level of skill or training.

8) Opinions and thoughts expressed are those of Bill Coleman and Frank Jolley and not Live Oak Bank.

9) Not all portfolios will necessarily own all companies mentioned, due to factors such as legacy positions, capital gain constraints, sector concentration, time, and other considerations. This is not a recommendation to buy or sell a particular security. The holdings identified herein do not represent all of the securities purchased, sold, or recommended by the adviser.

10) Live Oak Private Wealth claims compliance with the Global Investment Performance Standards (GIPS®) GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

11) To obtain information about GIPS®-compliant performance for Live Oak Private Wealth’s strategies or for a GIPS® report, please contact J. William Coleman, III at 910-839-8676.