“You make most of your money in a bear market; you just don’t know it at the time.”

– Shelby C. Davis

“I think it is almost impossible…to do well in equities over a period of time if you go to bed every night thinking about the price of them. I mean, I think about the VALUE of them. Focusing on the price of a stock is dynamite because it really means that you think that the stock market knows more than you do….The stock market is there to serve you and not to instruct you.”

– Warren Buffett

Welcome to the first of many quarterly letters from Live Oak Private Wealth. Since beginning work at Live Oak Private Wealth on September 4, I have been reminded almost daily what a special place this is. There is no doubt in my mind we have put together the best team in the wealth management business. I feel truly blessed to have such an experienced and dedicated team to help make a difference in clients’ financial lives.

I’ve spent much of my time these first several months marveling at the gorgeous campus we are part of. The Live Oak culture and entrepreneurial technology vibe are very energizing. As I meet many of the young, bright folks here, I’m reminded of the power of our collective community and reassured about the move here and the brightness of our future.

I feel fortunate and thankful that the majority of our clients have joined us. I won’t kid you; it was quite a challenge to plan and execute this transition. Not to mention that Hurricane Florence hit Wilmington directly during our first week in business. Nothing like a challenge of six days without power to make it even more interesting! I joked with the team after the hurricane that about the time we get recovered and up and running, the market will go into a tailspin. Boy did it ever! Partner Andy Basinger’s wife, Ashley, said: “no one said it was going to be easy.” Never underestimate a woman’s intuition.

So, here we are. Letter one at Live Oak Private Wealth. Download the full fourth quarter 2018 letter to learn more about Live Oak Private Wealth’s portfolio activity, performance characteristics and comments from the team.

Introduction

I have had to restart quarterly performance statistics as of September 30, 2018, at Live Oak Private Wealth. We have created two performance composites just like I have had in the past. Also as in the past, each client’s actual performance results may differ from that of the composites due to several factors. So starting in a big hole, our Equity Composite returned -10.51% net for the quarter versus the market’s return of -13.5% for the S&P 500 and -11.70% for the Russell 1000 value. Our Balanced Composite returned -8.9% net for the quarter versus the market’s return of -7.58% for the 60 S&P 500/40 BGCI.

As for the year, 2018 started where 2017 left off. The 5.7% gains in January were the best since 1997. The market would then sell off hard in February and March and claw and climb to an increase of 5% by the time it peaked in September. The move down in the fourth quarter was staggering, especially December. $3.7 trillion in market cap was erased which is equal to the entire GDP of India. The sentiment or bearishness led to the first 20% correction since 2009. December ’18 was the worst December since 1931. The big year we had in 2017 did a classic job of discounting the record “good news” about the economy to come this year. 3.7% unemployment, record consumer confidence, 3% + GDP growth, huge tax cuts, 25% earnings growth was I guess sniffed out in advance during 2017’s +22% year.

My last letter (June 30, 2018) referenced the rising risks in the market. The length of the economic recovery since 2009 was getting long in the tooth. The corresponding nine-year bull market might need to pause. I wrote about the effects of rising interest rates and shrinking liquidity, not to mention the concentration in large-cap tech stocks (FAANG). I underestimated the potential for a policy error around our trade policy. Comments from the Federal Reserve chairman during the first part of October related to interest rates was the trigger that started the volatile selloff. As I have written on multiple occasions, “our markets are unfortunately dominated by computer-driven systematic algorithmic trading of index baskets of stocks.” This exacerbated the selloff as it fed on itself during the quarter.

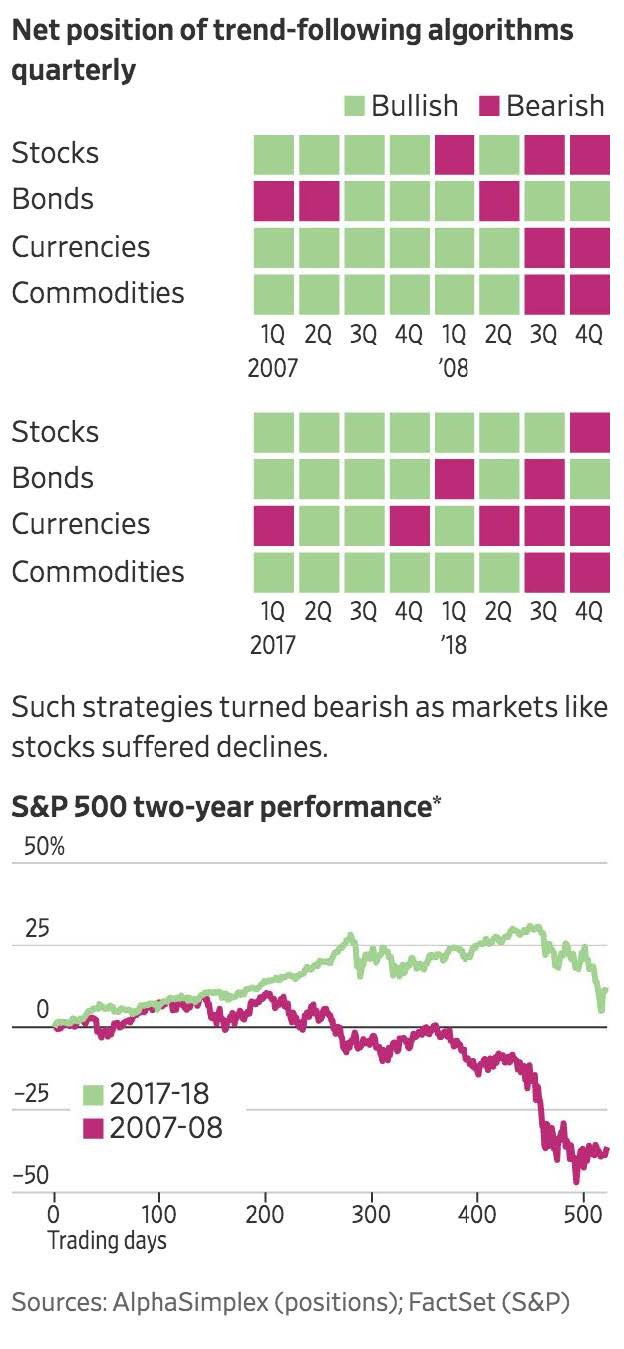

Trend-following speculative strategies, like these based on algorithms, have become a significant force in the markets. They went from bullish to bearish in the fourth quarter to a degree not seen in a decade. Recent volatility has pitted humans against these machines as the machines reinforce instability since they react to significant price swings by piling on the same trade and exacerbating the moves.

The charts below, courtesy of Alpha Simplex and the Wall Street Journal, reinforce this phenomenon in the markets today. The “chaos bet” as it was referred to:

So, we know what the market did during the end of the year, but how about the performance of the businesses we own? A massive disconnect in my humble opinion. The businesses we are invested in performed quite well, but their stocks did not. In the short run divergences like these occur. By the time the year was over, the decline in stock prices coupled with higher corporate earnings had reduced the multiple on 2019 consensus S&P estimates to less than 14 times. This multiple is about 15% below its historical average. The 10-year Treasury yield is less than 3% and therefore, doesn’t warrant this low of a P/E. Looking at the last 40 years, the 10-year Treasury has averaged over 6%, and stocks averaged a higher P/E. From this starting point, I would expect stocks of good businesses to outperform bonds by a long shot.

Portfolio Activity Since June 30, 2018

We established a new position in FedEx during December at the cost of $187. We also doubled up on our Schlumberger position for tax reasons on November 30th and sold the other half of the position bought previously. The original Schlumberger purchase, in hindsight, was a mistake, but by lowing our cost basis in this sound company, we should start to benefit from rising needs in energy engineering and services. FedEx is unmatched in its global network. FedEx links more than 99% of the world’s GDP by serving 220 countries and territories with 675 aircraft and nearly 180,000 motorized vehicles. FedEx sold off hard during December on disappointing earnings related to the China trade issues and poor results from their European division. FedEx dropped from a high earlier in the year of $274. At our entry price, we were paying the equivalent of 11.5 times earnings for one of the world’s most significant businesses.

Performance Characteristics From Calendar Year 2018 Focused Opportunity Model

Comments On Portfolio Positions

General Motors

GM is the 8th largest holding in our Focused Opportunity Model. We have owned GM since March of 2014 at the cost of $33.40. We owned GM long before the company acquired Cruise Automation, its autonomous vehicle unit. In May of 2018, Softbank announced a $2.25 billion investment in Cruise for a 20% stake. GM only paid $1.0 billion for Cruise. Then in October, Honda made an investment in Cruise that implied a valuation of $14.6 billion. That value is 20% of GM’s total market cap and isn’t even profitable yet. GM still trades in the mid-30s having gone into the mid-40s twice. Since GM went public in 2010 at $33, the company has cumulatively earned more than $33 per share and paid out over $7 per share in dividends. Some bullish GM analysts think just the truck and SUV division is worth the current stock price even before considering what Cruise might be worth. GM sells at a very modest six times 2019 earnings and offers a well-supported dividend yield. GM remains a particularly compelling investment opportunity in my view.

Brookfield Asset Management

We have owned Brookfield for as long as I can remember. Brookfield is the world’s largest global hard asset manager in the world. By hard assets, I mean real estate, utilities, and infrastructure. In today’s world, many advisors promote “alternatives.” I would put Brookfield’s management and performance up against any alternative strategies. Brookfield has delivered 16.8% compounded total returns for the last 14 years compared to 8.5% for the S&P 500 and no telling how much less for the “alternative” funds. According to a recent OECD report, by 2040, the world is going to need to invest nearly $100 trillion in additional infrastructure to support a fast-growing and rapidly urbanizing population. Brookfield’s excellent track record of high returns and trusted brand means it stands to benefit significantly from these trends. Brookfield trades at a very favorable 8.6 times its funds from operations.

Charles Schwab

Schwab continues to rapidly expand its banking subsidiary which has helped to blunt some weakness in its core asset management business. Schwab has done an excellent job of executing lo w-risk strategies with its balance sheet, which has yielded outsized returns and should serve to offset revenue volatility associated with quarters like we just witnessed. Hopefully, higher net interest margins will accompany higher interest rates in 2019, and along with prudent expense management and excess capital to deploy for buybacks, I expect Schwab to have a good year.

Apple

Apple was a lightning rod stock recently. On the fundamental front, in their most recent earnings report, Apple reported +20% sales growth, driven by a 30% increase in iPhone revenue and a 20% increase in software and services revenue. Management recently guided down expectations for future revenue due to a sudden slowdown in demand for the iPhone in China. Despite this near-term bearishness, I think Apple has a solid strategy for growth over the next several years. Also, I think the next few years of faster growth in higher margin software services will lead to stickier gross margins at the company. Apple trades around 12 times 2019 earnings estimates of $12.00 per share. That is a substantial discount to the market and one that Apple’s management will take advantage of through large share buybacks.

There have been several comments lately about a recession. Much of it is in reaction to the market’s selloff. I don’t know about you, but it sure feels like we are quite a w ays away from a recession. Yes, there is some slowing in economic conditions, especially globally. Yes, the effects of growth are currently hampered by the ongoing trade skirmish. There are typically a few items always present at the onset of a recession and corresponding prolonged bear market in stocks.

1) Problematic inflation: if wage inflation is around 3.5% or higher, it’s a problem (it’s currently well below that). Core consumer prices more than 3%, which we do not see either.

2) A hostile Federal Reserve: raising rates well above neutral (in this case 2.5-3%). The Fed is gradually lifting rates and is data dependent not to be hostile.

3) Valuation: current multiples are not extended related to history and certainly not related to current interest rates.

I would expect that global policy issues related to trade, gradually rising interest rates and reduced liquidity, will most probably cause short-term earnings pressures on our portfolio companies. I feel that we are sufficiently compensated for that risk given where current stock prices are. As many of you know, I am an optimist and I remain patient and believe that owning these businesses at these prices will allow us to endure the fears of today.

I believe successful investing requires the knowledge to be able to accurately value businesses for investment as well as an understanding of market psychology. As mentioned many times in letters before, the stock market’s cyclical nature produces periods of overvaluation, fair valuation and then undervaluation, before reversing and repeating itself. Investor emotions drive this classic market cycle during each period. The understanding of these market cycles is critical to your success as an investor so that you do not make the mistake of following the herd mentality and suffering as a result. It is hard to determine precisely when we enter each of these periods, and we can’t predict with accuracy when the next significant market buying opportunity will occur. All we can do is remain patient and aware of opportunities. To be a successful investor, you need to not only buy when it is emotionally the hardest, and sell when it is emotionally the hardest, but also sit patiently and do nothing for long periods while good businesses compound.

For the benefit of new readers of these quarterly letters, I have been writing them four times a year for 19 years. Investors do all kinds of exercises to make sense of the world – modeling scenarios in spreadsheets, conducting diligence on managers, or reading pitch decks. But few activities help clarify your thoughts better than writing. Writing is the ultimate test of whether your ideas make sense or are merely gut feelings. Putting your thoughts on paper forces them into an unforgiving reality where you have to look at the words and interpret them as another reader will see them. If you are reading this letter for the first time, it may be helpful for you to understand our beliefs, investment philosophy and guiding principals. These core beliefs typically drive a lot of our thoughts that we are writing about. Therefore, our Live Oak Private Wealth investment philosophy, beliefs and guiding principals are found in the appendix to this letter.

In closing, it is a privilege to write to you and report on our progress as a new investment firm. There is no doubt in my mind that Live Oak Private Wealth is the best team in the wealth management business. I’m personally blessed to be a part of an extraordinary team. Your trust in our team is a responsibility we do not take lightly. We are all thankful and appreciative for the opportunity to continue working with you at Live Oak.

We feel privileged and humbled by your willingness to compensate us for doing something that we love to do and is so meaningful and rewarding to us all.

On behalf of the team, we look forward to our continued shared success in this relationship.

Warmest Personal Regards,

J. William Coleman, III

Managing Director

Chief Investment Officer

Appendix 1

Live Oak Private Wealth Investment Philosophy

Three Pillars

We consider potential losses before gains. We think about multiple scenarios that could affect us. We ask how much might we lose before we ask how much we might make.

We focus on absolute returns, not relative returns. Our goal is to lose less than the market. We don’t manage to a benchmark.

We do not focus on the macroeconomic environment. We focus on great businesses we can invest in at a fair price.

Our Beliefs

We believe your lifetime investment results will be mostly governed by two variables: behavior and asset allocation.

We consider the three quotes below by two very famous investors daily in our thoughts, research and work.

“To buy when others are despondently selling and to sell when others are avidly buying requires the greatest fortitude

and pays the greatest reward.” – John Templeton

“Be fearful when others are greedy and greedy when others are fearful.”

“Price is what you pay; value is what you get.” -Warren Buffett

Guiding Principals

- A share of stock represents a share in the ownership of a business.

- A stock exchange is nothing more than an auction place that provides a convenient means for exchanging your

ownership in business for cash and vice-versa. - Our investment approach would be akin to applying a private equity mindset to investing in public markets.

- We limit our search for qualifying investments to good businesses. They have identifiable, sustainable competitive

advantages. - Risks to us are permanently losing capital over a five-year time horizon. Market volatility is not a risk to us.

- Our primary return goal is to compound money at real rates of return (4-5%) above inflation over our five-year time

horizon. - Compounding capital at 7% doubles your assets in 10 years.

Disclosures

1) Past performance is no guarantee of future results and future performance may be higher or lower than the performance shown.

2) This performance composite represents results from all actively managed, fully invested accounts at the firm. The composite results include all accounts managed for capital appreciation and income.

3) There can be no assurance that our portfolio management or any account managed by our investment managers will achieve a targeted rate of return or volatility or any other specified parameters. There is no guarantee against loss resulting from an investment.

4) Performance is presented net of fees. Calculated using Orion standards. Periods greater than one year are annualized. This information has been obtained from sources that were deemed reliable, but cannot be guaranteed nor verified.

5) The method for calculating the composite returns includes a monthly weighted (weighting of monthly beginning values, adjusting for time-weighted average returns to derive quarterly and annual returns.

6) Investment objectives, returns, and volatility are used for measurements and/or comparison purposes only and are only a guideline for prospective investors to evaluate our investment strategy and the accompanying risk/reward ratios.

7) Comparison to any index is for illustrative purposes only. Certain information, including index and benchmark information, has been provided by third-party sources, and although believed to be reliable, has not been independently verified and its accuracy cannot be guaranteed.

8) The information contained here is not complete, may change, and is subject to, and is qualified in its entirety by, the more complete disclosures, risk factors, and other important information contained in Part 2A or 2B of Form ADV. This presentation is for informational purposes only and does not constitute an offer to sell or as a solicitation.

9) Live Oak Private Wealth is a subsidiary of Live Oak Bank. Investment advisory services are offered through LOPW, LLC, an Independent Registered Investment Advisor.

10) Opinion and thoughts expressed are those of Bill Coleman and not Live Oak Bank.