Though not related by blood, Jimmy Buffett and Warren Buffett shared a lasting connection. Their friendship rarely made headlines, but quiet glimpses reveal the warmth between them. At the 2007 Berkshire Hathaway annual meeting, Jimmy was invited to perform and delivered a special rendition of Margaritaville, playfully changing the lyrics to:

“Wasting away in Berkshire Hathaway-a-ville / Searchin’ for some good companies to buy.”

Following Jimmy’s passing, Warren fondly recalled their first conversation:

“We weren’t related, but in his first call to me, he began with ‘Cousin Warren?’ and I replied, ‘Cousin Jimmy’—and that’s the way it stayed.”1

Their bond extended beyond a shared surname. Jimmy, the laid-back troubadour of Margaritaville, and Warren, the legendary investor from Omaha, each built empires rooted in values, vision, and clarity. Though their paths were different, both offer powerful estate planning lessons—some inspiring, others cautionary—for anyone seeking to pass on wealth and wisdom with intention.

Cousin Jimmy’s Estate Planning Insights

Jimmy Buffett’s billion-dollar brand included music, restaurants, hotels, and merchandise. Yet after his death in 2023, a legal dispute erupted over his $275 million estate. At the center of the controversy is a Marital Trust intended to provide for his wife, Jane Buffett, throughout her lifetime, with the remaining assets designated to pass to their three children upon her death.

Despite decades of estate planning, the conflict between Jane and co-trustee Richard Mozenter reveals a critical truth: even the most well-drafted documents can falter without clear communication, shared expectations, and proactive preparation.

Both Jane and Richard have filed complaints seeking the other’s removal as co-trustee, each citing serious concerns about the other’s conduct and impact on the trust.

Jane alleges Richard has failed to act in her best interest as the sole current beneficiary—making unilateral decisions, obstructing her efforts to manage expenses and engage trusted advisors, and refusing to provide basic financial information. She claims this has left her unable to understand or plan for her financial future. She describes his behavior as disrespectful and obstructive, arguing that it has undermined the trust’s purpose.2

Richard, in turn, contends that Jane has prioritized her own interests over her fiduciary duties—refusing to meet, blocking the appointment of a successor trustee, interfering with staff, and even threatening to remove her daughter as a beneficiary. He argues her conduct has made trust administration unworkable.3

While the legal arguments are complex, the underlying issue seems to stem from a lack of preparation and transparency—on both Jane’s and Richard’s parts. As both beneficiary and co-trustee, Jane stepped into roles she may not have fully understood. Her petition reveals unfamiliarity with the cost of their lifestyle, the structure of their assets and income, and how to work with Richard in these new roles—someone with whom she seemingly had no prior working relationship, yet who now plays a central role in her financial life.4

Compounding the situation is the absence of clear guidance from Jimmy regarding his intentions for distributions, lifestyle support, or how he envisioned the co-trustees working together. Without this context, even a well-drafted trust can become a source of confusion and conflict.

In his filing, Richard included the full trust agreement, which appears legally sound and thoughtfully constructed. However, legal documents—while essential—can only go so far. They provide structure, but not the shared understanding and emotional readiness needed to carry out a plan effectively. This conflict underscores that legal clarity alone is not enough. Successful estate planning also depends on open communication, mutual trust, and a shared vision among all parties involved.

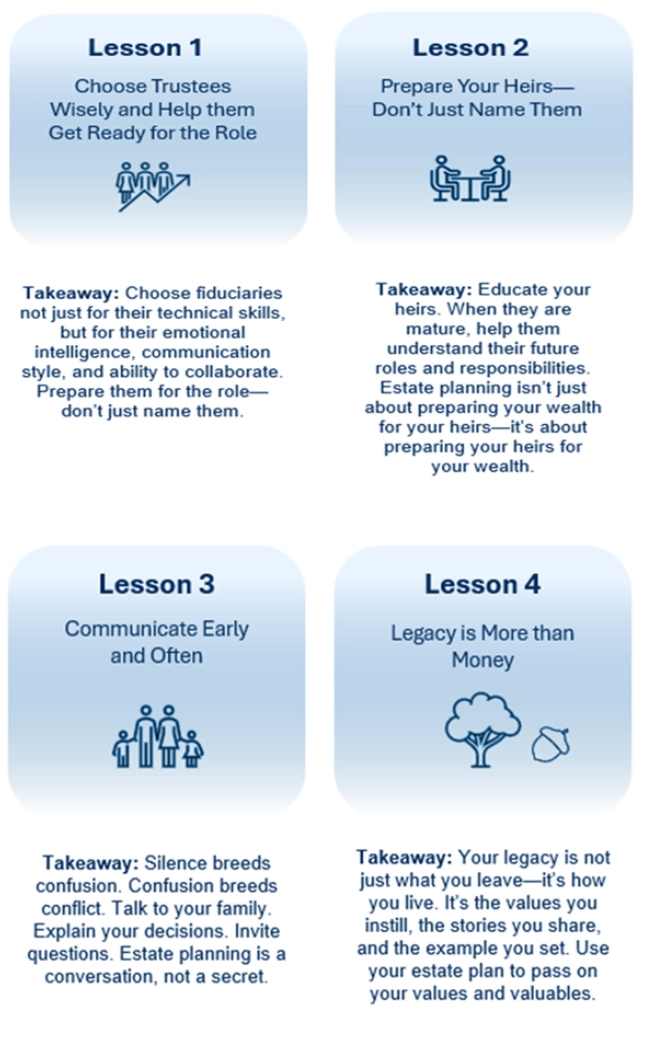

Key Takeaways:

- Beneficiary Education & Distribution Clarity. Jane’s limited financial awareness and the uncertainty around trust distributions highlight two critical needs in estate planning: preparing beneficiaries through financial education and clearly communicating expectations to beneficiaries and trustee for lifestyle support. Especially in complex estates, proactive engagement and guidance can prevent confusion and conflict later on.

- Trustee Selection & Fiduciary Preparedness. The conflict between Jane and Richard highlights the importance of thoughtful trustee selection and thorough preparation. Naming co-trustees without ensuring compatibility, communication, and emotional readiness can lead to dysfunction—even when legal documents are sound. Fiduciary roles require more than technical expertise or family ties; they demand training, support, and a shared understanding of responsibilities from the outset.

- Communication & Transition Planning. Jane’s lack of relationship with her co-trustee and Jimmy’s business advisor reflects a missed opportunity for transition planning. Surviving spouses should be introduced to key advisors and their roles well in advance.

- Family Dynamics. Emotional tensions revealed in the litigation show how unresolved relational issues can derail estate plans. Addressing family dynamics through facilitated conversations or mission statements can help preserve harmony.

- Privacy. The public nature of the dispute undermines the privacy trusts are meant to protect. Including conflict resolution mechanisms and fostering proactive communication can help avoid litigation.

Cousin Warren’s Estate Planning Insights

While Jimmy’s estate and trust litigation revealed the risks of vague roles and inadequate preparation, Warren Buffett presents a compelling counterexample—one grounded in clarity, simplicity, and trust. His November 2024 News Release to Shareholders offers meaningful insights into his estate planning approach.5 As expected, Warren’s philosophy is as deliberate and values-driven as his investment strategy.

In his 2024 Release, Warren shared how he and his late wife, Susie, planned to direct the vast majority of their wealth toward philanthropy, leaving modest gifts to their children. His guiding principle? “Leave your children enough so they can do anything, but not enough so they can do nothing.”6

When Susie passed away in 2004, she left $10 million to each of their three children—Susie, Howie, and Peter. Warren noted this was the first significant gift they had received. At the time, he felt they were not yet ready to manage the immense wealth tied to Berkshire Hathaway shares. However, over time, they demonstrated their readiness through enthusiasm, diligence, and responsible stewardship of the family’s philanthropic legacy. During this period, Warren also observed that while his children appreciated financial comfort, they were “not preoccupied with wealth”.

This experience became a powerful learning journey for both Warren and his children. He watched them “grow into good and productive citizens,” gaining confidence in their ability to handle the responsibilities that come with generational wealth. Despite differing views among them, Warren emphasized their “unwavering” shared values and expressed “extraordinary confidence” in their abilities.7

In addition to gradual wealth transfers with oversight, early exposure to philanthropy, mentorship, and providing beneficiaries time to learn and grow, Warren suggests that all parents, whether of “modest or staggering wealth”, discuss their estate planning documents with their beneficiaries when they are mature. He has encouraged his children to read and understand his estate planning documents, welcomed their questions, and made changes based on their feedback. His goal was simple: prevent confusion and conflict by fostering clarity and shared purpose so they are not left asking “why?” when he is no longer able to respond.8

Like Jimmy, Warren’s estate plan reflects decades of thoughtful preparation and legally sound documentation. Yet, where Jimmy’s plan faltered, Warren’s is poised for success. At the very least, Warren has the distinct privilege of holding “extraordinary confidence” in the legacy he’s built—thanks to his deliberate efforts to educate his heirs and fiduciaries, foster collaborative engagement, and entrust them with the responsibility of carrying forward the family’s values and philanthropic vision.

Key Takeaways:

- Early Exposure to Philanthropy. Warren and Susie encouraged their children to engage in small-scale philanthropy from a young age, instilling values of generosity, diligence, and social responsibility. Philanthropy was treated as a legacy tool—not just a tax strategy.

- Gradual Wealth Transfer with Long-Term Mentorship. Beginning in 2006, Warren and Susie gave their children increasing responsibility over family foundations and personal wealth. Over nearly two decades, Warren observed and mentored them as they led philanthropic teams, developed leadership skills, and gained hands-on experience in managing both financial and human dynamics. This gradual approach allowed them to grow into their roles with confidence and accountability.

- Open Communication. Warren encouraged parents to let their children read and understand their wills before signing. He believed that transparency strengthens family bonds and prevents future conflict.

- Simplicity & Flexibility in Planning. Simplicity and flexibility are powerful. Warren revises his will every few years, keeping it simple and involving his beneficiaries in the process. This avoids complexity that could lead to misinterpretation or family discord.

- Wealth as a Tool, Not a Trophy. Buffett’s philosophy centers on using it to improve lives— not to elevate status.

Conclusion: Estate Planning Is More Than Paperwork

Estate planning is not just about avoiding taxes or probate—it is about empowering the next generation to carry on the legacy you have worked so hard to build. The litigation between Jane Buffett and Richard Mozenter underscores a critical truth: estate planning is not just about documents—it is about people. Whether you are a billionaire or a beachcomber, the lessons are the same.

DISCLOSURES:

This material is not financial advice or an offer to sell any product and is not a recommendation to buy or sell any particular security. Past performance is not indicative of future results. The opinions expressed are those of the Live Oak Private Wealth Management Investment Team. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass.

Live Oak Private Wealth is a subsidiary of Live Oak Bank. Investment advisory services are offered through LOPW, LLC, an Independent Registered Investment Advisor. Registration does not imply a certain level of skill or training. More information about Live Oak Private Wealth, including our advisory services, fees, and objectives, can be found in our ADV Part 2A and/or Form CRS, which is available upon request.

This should not be construed as tax advice. You should always consult with your tax professional with regard to specific tax questions and obligations.

1 “Warren Buffett Remembers Cousin Jimmy.” The Wall Street Journal, 5 Sept. 2023, https://www.wsj.com/livecoverage/stock-market-today-dow-jones-09-05-2023/card/warren-buffett-remembers-cousin-jimmy–b8wXXSs2AD97YH347KNV?__source=newsletter%7Cwarrenbuffettwatch.

2 In re the James W. Buffett 1990 Declaration of Trust, No. 25STPB06357 (Cal. Super. Ct. L.A. Cnty. filed June 3, 2025) (Petition).

3 Mozenter v. Buffett, No. 502025CP002725 (Fla. Cir. Ct. Palm Beach Cnty. filed June 2, 2025) (Complaint).

4 Buffett Trust Petition, No. 25STPB06357.

5 Berkshire Hathaway Inc. News Release. November 25, 2024. https://www.berkshirehathaway.com/news/nov2524.pdf

6 Buffett, News Release, 2024.

7 Buffett, News Release, 2024.

8 Buffett, News Release, 2024.