Tax policy and the temporary or “sunsetting” provisions of the 2017 Tax Cuts and Jobs Act (TCJA) have become a large focus of the 2024 U.S. presidential election. It’s important to understand that on December 31, 2025, this “sunset” expires several tax benefits (including the increased gift, estate and GST tax exemptions) of the TCJA unless Congress passes legislation. For an in-depth description of specific TCJA expiring tax provisions, see Table I included in CRS Report R47846, Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act” (TCJA, P.L. 115-97), by Margot L. Crandall-Hollick, Donald J. Marples, and Brendan McDermott at (https://crsreports.congress.gov/product/pdf/R/R47846).

How do election outcomes impact tax policy?

For the temporary provisions of the TCJA to be extended or modified, Congress must act. Typically, the biggest policy advancements occur when one party controls the White House and both houses of Congress. In addition to the Presidential race, a total of 468 seats in the U.S. Congress are up for election in November. That includes 33 of the 100 seats in the U.S. Senate (currently under narrow Democratic control) and all 435 seats in the U.S. House of Representatives (currently under narrow Republican control). Whether the election outcome results in one-party control of both houses of Congress and the Presidency, or a split between the parties as exists today, is yet to be seen.

At the presidential level, the candidates continue to issue additional tax policy details as the election approaches. You can stay up to date on tax policies proposed by presidential candidates by visiting the Tax Foundation’s “Tracking 2024 Presidential Tax Plans” resource page at https://taxfoundation.org/research/federal-tax/2024-tax-plans/

What are some of the potential impacts of “sunset” or extension of the TCJA?

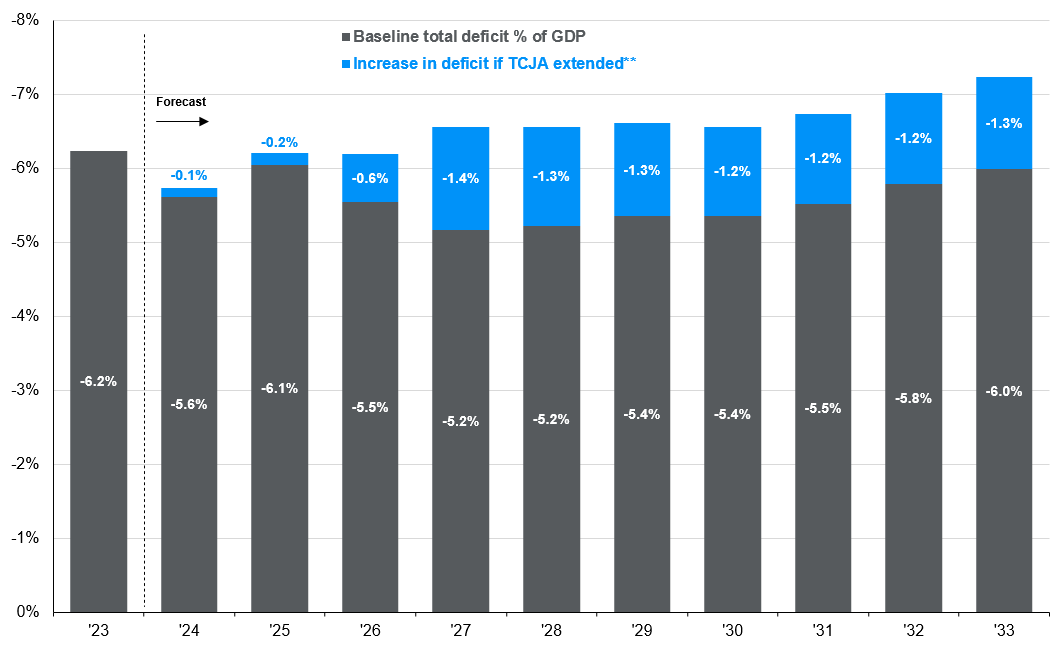

Under current law, the Congressional Budget Office (CBO) projects individual tax revenue to increase after 2024 because of the expiration of tax cuts under the temporary TCJA provisions. If the individual tax provisions are extended, this would create new federal budget deficit concerns from the resulting tax collection reduction (an estimated addition of $2.6 trillion to the federal debt through 2033 – $2.5 trillion from individual tax rate changes and $126 billion from estate tax exemption changes). If the TCJA tax cuts “sunset” and the taxpayers’ bills increase by $2.6 trillion over the next decade, this could impact consumption and consequently growth. This tension is what makes the policy decision delicate and difficult.

% of GDP, 2024 – 2033, impact based on CBO Baselines Forecast

*Estimates are based on the Congressional Budget Office’s (CBO) “The Budget Outlook and Economic Outlook: 2024 to 20234.” **Assumes the following provisions from the TCJA are extended: changes to individual income tax provisions, higher estate and gift tax exemptions, changes to the tax treatment of investment costs, and maintaining certain businesses tax provisions going into effect in 2023.

Disclosures:

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass.

Live Oak Private Wealth is a subsidiary of Live Oak Bank. Investment advisory services are offered through LOPW, LLC, an Independent Registered Investment Advisor. Registration does not imply a certain level of skill or training. More information about Live Oak Private Wealth, including our advisory services, fees, and objectives, can be found in our ADV Part 2A or 2B of Form ADV, which is available upon request.